Robinhood is a popular investment app that allows users to trade stocks, options, and cryptocurrencies without paying commissions. While the app has gained a lot of popularity in recent years, some users have reported issues with withdrawing their funds. In particular, some users have noticed that their withdrawable cash on Robinhood is $0. In this article, we will explore the reasons why this might be the case.

One possible reason why your withdrawable cash on Robinhood is $0 is that your account is restricted. Robinhood sometimes restricts users’ accounts for various reasons, such as if the user has a negative balance, had a bank account transaction reversed, or is suspected of fraud. If your account is restricted, you may not be able to withdraw your funds until the issue has been resolved.

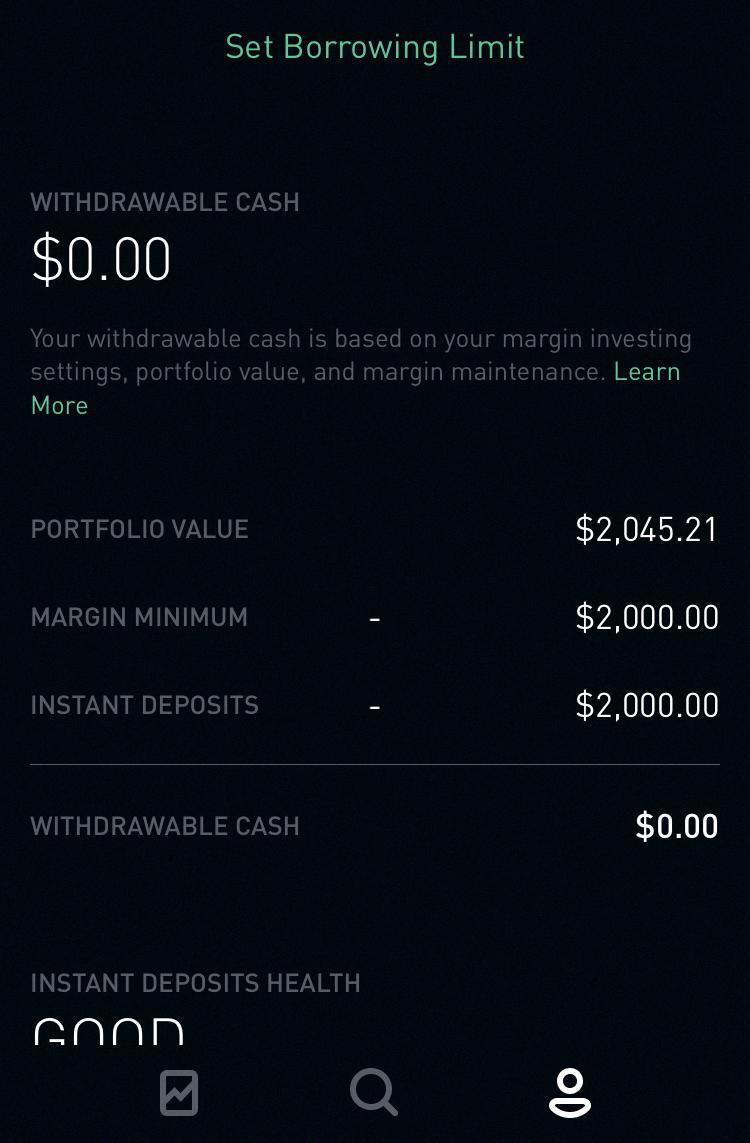

Another reason why your withdrawable cash on Robinhood is $0 is that you may have unsettled funds in your account. When you make a deposit or sell a stock, the funds may take up to two trading days to settle in your account. During this time, the funds are not available for withdrawal. If you try to withdraw funds before they have settled, your withdrawable cash will be $0.

It is also possible that you may have pending orders or open positions in your account that are preventing you from withdrawing your funds. If you have pending orders or open positions, your withdrawable cash will be reduced by the amount needed to cover those orders or positions. You will only be able to withdraw the remaining funds that are not tied up in pending orders or open positions.

Lastly, it is important to note that Robinhood may charge a fee for withdrawing your funds. The fee varies depending on the amount you are withdrawing and the payment method you are using. If you have a small amount of funds in your account, the withdrawal fee may make it not worth withdrawing your funds.

There are several reasons why your withdrawable cash on Robinhood maybe $0. It could be due to a restriction on your account, unsettled funds, pending orders or open positions, or withdrawal fees. If you are having trouble withdrawing your funds, it is best to contact Robinhood’s customer support for assistance.

Unable to Withdraw Robinhood Cash

There could be several reasons why your Robinhood cash is not withdrawable. One possible reason is that your account may be restricted by Robinhood. This can happen if you have a negative balance in your account or if you have had a bank account transaction reversed. Another reason could be suspected fraudulent activity on your account. It is also possible that there may be a technical issue with the Robinhood app or platform that is preventing you from withdrawing your cash. To resolve this issue, you should contact Robinhood customer support for further assistance. They will be able to provide you with more information about the specific reason why your cash is not withdrawable and help you resolve the issue.

How Long Does It Take to Withdraw Cash From Robinhood?

Typically, it takes at least 2 trading days for any funds in your Robinhood account to settle and become withdrawable. During this time, the money is processed and verified by the financial institutions involved in the transaction. Once the funds have settled, they will be available for withdrawal and can be transferred to your linked bank account or used to make trades. It is important to note that the specific timing for fund settlement can vary based on a variety of factors, including the type of transaction and the processing times of the involved financial institutions. To ensure that you have the most up-to-date information on when your funds will be available for withdrawal, it is recommended to check your Robinhood account regularly and monitor any pending transactions.

Withdrawing Cash from Robinhood

To get withdrawable cash in Robinhood, you need to first sell any investments you have in your account. Once you have sold your investments, the cash from the sale will become available for withdrawal. To withdraw the cash, open the Robinhood app and access your account via the icon at the bottom-right corner of the screen. From there, find the “Transfers” menu and select “Transfer to Your Bank.” Next, find your bank account in the list and choose it. Enter the amount that you want to withdraw and confirm the transfer. The money should arrive in your bank account within a few business days. It is important to note that there may be a waiting period before you can withdraw funds from Robinhood after making a deposit or selling an investment. This waiting period can vary depending on the specific circumstances of your account.

Conclusion

Robinhood has become a popular investment platform for many individuals due to its user-friendly interface and commission-free trading. However, it is important to note that there have been some concerns about the reliability and security of the platform, as well as potential restrictions on user accounts. If you are considering using Robinhood, it is recommended that you do your own research and weigh the pros and cons before making any investment decisions. Additionally, always remember to stay informed about the market and keep a close eye on your investments to ensure that you are making informed decisions that align with your financial goals.