Venmo is a mobile payment service owned by PayPal, Inc. It allows users to transfer money to one another using a phone app. The app is available on both iOS and Android platforms. Venmo has over 7 million active users and was processing more than $40 billion in payments per year.

In March 2016, Venmo was acquired by PayPal for $800 million. At the time of the acquisition, Venmo was processing $20 billion in payments per year. In January 2018, that number had grown to $40 billion.

Venmo is popular with millennials, who make up the majority of its user base. In fact, a recent study found that 34% of all U.S. adults aged 18-34 have used Venmo in the past year.

Despite its popularity, Venmo has not been without its problems. In 2016, the company was criticized for its lax security measures after it was revealed that hackers had stolen millions of dollars from Venmo accounts.

In 2017, Venmo came under fire again when it was revealed that the company had been sharing users’ transaction data with advertisers. The company has since made changes to its privacy policy and now only shares aggregated and anonymized data with third parties.

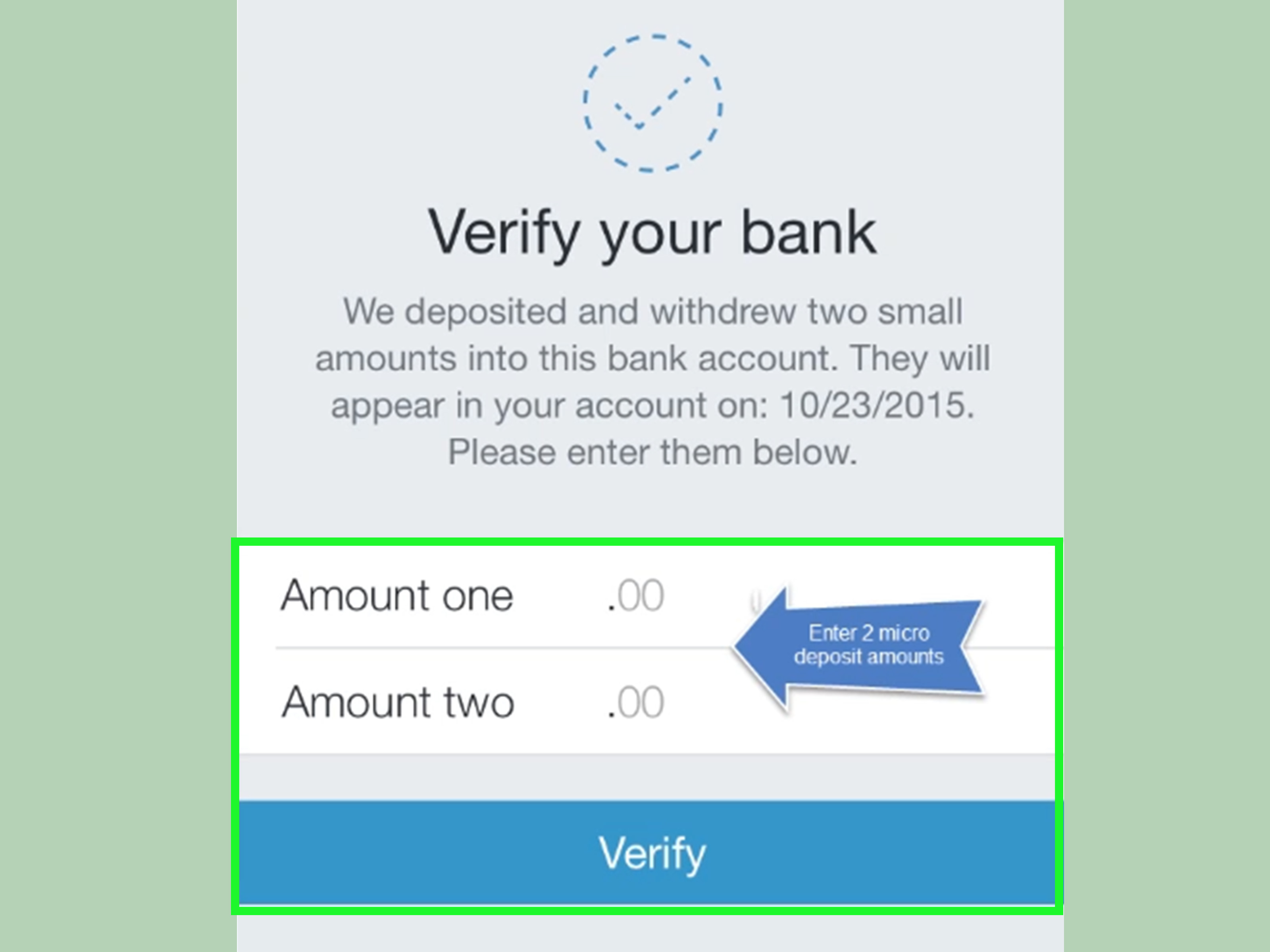

If you’re thinking of using Venmo, there are a few things you should know. First, you’ll need to create an account with either a phone number or email address. Once your account is created, you can link your bank account or debit card so you can start making payments.

Venmo is free to use if you’re sending money from your bank account, debit card, or PayPal balance. There’s a 3% fee if you’re sending money from a credit card. When you receive money, it goes into your Venmo balance. You can then either spend that money using your Venmo debit card or transfer it to your bank account.

One thing to keep in mind is that Venmo is not a replacement for a traditional bank account. If you’re looking for a mobile payment service that’s easy to use and popular with millennials, Venmo is a good option. Just be sure to link your bank account or debit card so you can avoid fees, and keep in mind that Venmo is not a replacement for a traditional bank account.

How Can I Unfreeze My Venmo Account?

If your Venmo account has been frozen, you will need to contact us for assistance. We apologize for any inconvenience this may cause.

Why Is My Venmo Account Still Frozen?

There are a few reasons why your Venmo account might be frozen. One possibility is that you have exceeded the number of ACH transfers permitted on your account. Another reason might be that you do not have enough funds at the time of the transaction. The fastest way to get your account reinstated is to use a debit card to pay back the amount.

How Long Does Venmo Freeze Your Account?

Venmo can freeze your account for a number of reasons, including if the user has violated the Acceptable Use Policy. Venmo may also freeze an account to protect agaist the risk of liability. Venmo will usually hold money in a user’s account for up to 180 days, but this may vary depending on the reason for the freeze.

How Long Does Venmo Take To Unfreeze Account?

Venmo can take up to 2-3 days to unfreeze an account that has insufficient funds. This is because Venmo needs to ensure that the account has enouh funds to cover the overdraft debt. If you transfer the funds to your Venmo account to cover the overdraft debt, it should unfreeze in 2-3 days.

How Do I Unfreeze My Account?

There are a few ways to unfreeze your bank account. The most common way is to have the judgment vacated. This means that the court will officially erase the judgment against you, and your account will be released automatically. Another way to unfreeze your account is to negotiate a payment plan with the creditor or debt collector. Once you have made a payment plan and paid off at lest part of your debt, the creditor or debt collector can no longer freeze your account. Finally, you can file for bankruptcy. If you file for bankruptcy, the automatic stay will prevent the creditor or debt collector from freezing your bank account.

How Do I Recover My Venmo Account?

There are a few ways to recover your Venmo account:

1. If you remember your email address or phone number assocated with your account, you can reset your password by clicking “Forgot Password?” on the sign-in page.

2. If you have access to the email address or phone number asociated with your account, you can contact Venmo and request that they reset your password for you.

3. If you don’t have access to the email address or phone number associated with your account, you can prvide Venmo with a photo of a valid form of ID so that they can verify that it’s you and reset your password.

How Do I Know If My Venmo Is Frozen?

There are a few ways to tell if your Venmo account is frozen. The frst is if you do not receive an email from Venmo notifying you of the freeze. The second is if you attempt to make a payment and receive a pop-up message telling you that your account is frozen. If you experience either of these, your Venmo account is most likely frozen.

What Happens If I Don’t Verify My Identity With Venmo?

If you do not verify your identity with Venmo, you will not be able to continue using your Venmo balance for payments. You will still be able to receive payments and transfer money out of your Venmo account to a bank account.

Can I Delete My Venmo Account And Make A New One?

Yes, you can delete your Venmo account and make a new one. However, you will need to add your bank details again if you want to use Venmo in the future.

How Do I Talk To A Live Person At Venmo?

When you need to talk to someone at Venmo, there are a few ways to do so. You can email them by filling out the form on their website, chat with them in their mobile app, or call them at (855) 812-4430.