Varo Bank is a digital bank that offers a range of financial services, including overdraft protection. Overdraft protection is an optional service that allows you to withdraw more money than you have in your account, up to a certain limit. The overdraft limit is the maximum amount that the bank will allow you to withdraw.

Varo Bank’s overdraft limit is up to $50. This means that if your account balance is negative, Varo Bank will automatically cover the overdraft up to $50. However, it’s important to note that this service comes with fees. Varo Bank charges a $15 fee for each overdraft transaction that exceeds $10.

It’s also worth mentioning that Varo Bank’s overdraft protection is a discretionary service. This means that Varo Bank may decline any transaction that would cause your account to go into overdraft, even if you have overdraft protection.

If you require more financial assistance, Varo Bank offers a loan option with no unexpected costs, overdraft fees, or unfair late fees. This loan option allows you to borrow money at a fixed interest rate, with flexible repayment terms.

In general, overdraft protection can be a useful tool for managing your finances, but it’s important to use it wisely. Overdraft fees and interest rates can add up quickly, so it’s important to monitor your account balance and avoid unnecessary overdrafts.

Varo Bank’s overdraft limit is up to $50, and the bank charges a fee for each overdraft transaction that exceeds $10. While overdraft protection can be a helpful service, it’s important to use it responsibly and monitor your account balance to avoid unnecessary fees.

Understanding Varo’s Overdraft Policy

Varo Bank offers overdraft protection of up to $50 for eligible customers. This means that if you have a Varo Bank account and meet certain eligibility requirements, you can overdraw your account up to $50 without incurring any overdraft fees. It is important to note, however, that overdrafts must still be repaid and may incur other fees or charges over time. Additionally, Varo Bank also offers loan options for customers who require further financial assistance with no hidden costs, overdraft fees, or unfair late fees.

Does Varo Bank Offer Overdraft Protection?

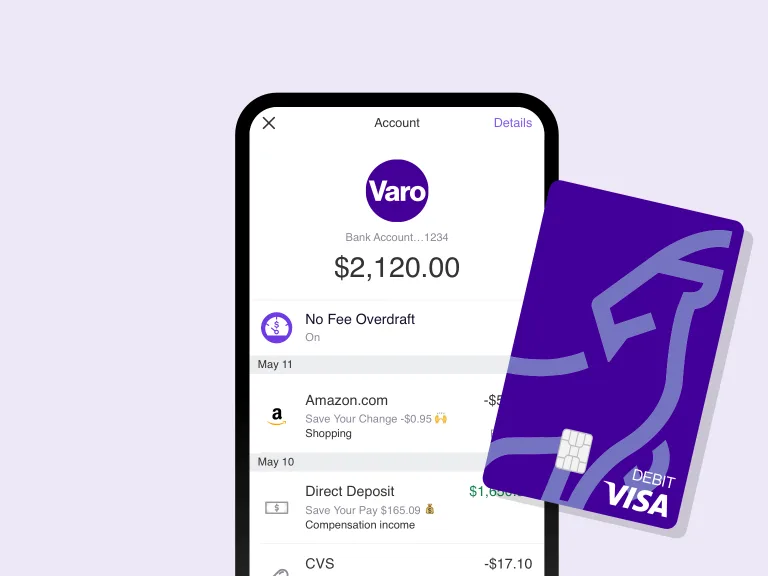

Varo Bank allows overdraft protection. However, to use this feature, your account balance needs to go negative. Varo Bank offers a service called “No Fee Overdraft” which allows eligible account holders to overdraft up to $50 with no fee. If you overdraft more than $50, the bank charges a fee of $15 per transaction. It’s important to note that overdraft protection is optional, and you must opt in to use it. Additionally, Varo Bank may decline any transaction that would cause your account balance to go negative if you do not have overdraft protection enabled.

The Maximum Amount of an Overdraft

When it comes to overdrafts, the amount you can overdraft depends on the overdraft limit set by your bank. The overdraft limit is the maximum amount that the bank allows you to withdraw from your account, even if there are no funds available in your account. The limit varies from bank to bank and can range from a few hundred dollars to several thousand dollars.

It’s important to note that while you can withdraw up to your overdraft limit, doing so will result in overdraft fees and interest charges. These fees and charges can add up quickly, so it’s important to keep track of your account balance and avoid overdrawing your account if possible.

Some banks also offer overdraft protection, which can help you avoid overdraft fees by automatically transferring funds from a linked account or line of credit to cover any overdrafts. However, this service typically comes with its own fees and interest charges, so it’s important to read the fine print and understand the costs involved.

The amount you can overdraft depends on your bank’s overdraft limit, which can vary widely. It’s important to be aware of your account balance and the costs associated with overdrafts and overdraft protection to avoid costly fees and charges.

Conclusion

Varo Bank offers overdraft protection to its account holders with a maximum limit of $50. While this may seem low compared to other banks, it can still provide a helpful safety net in case of an unexpected expense or payment. However, it’s important to note that using overdraft protection will result in a negative balance and potential fees. For those who require more financial assistance, Varo Bank also offers loan options with transparent and fair terms. As with any financial decision, it’s important to carefully consider your options and make the best decision for your individual needs and circumstances.