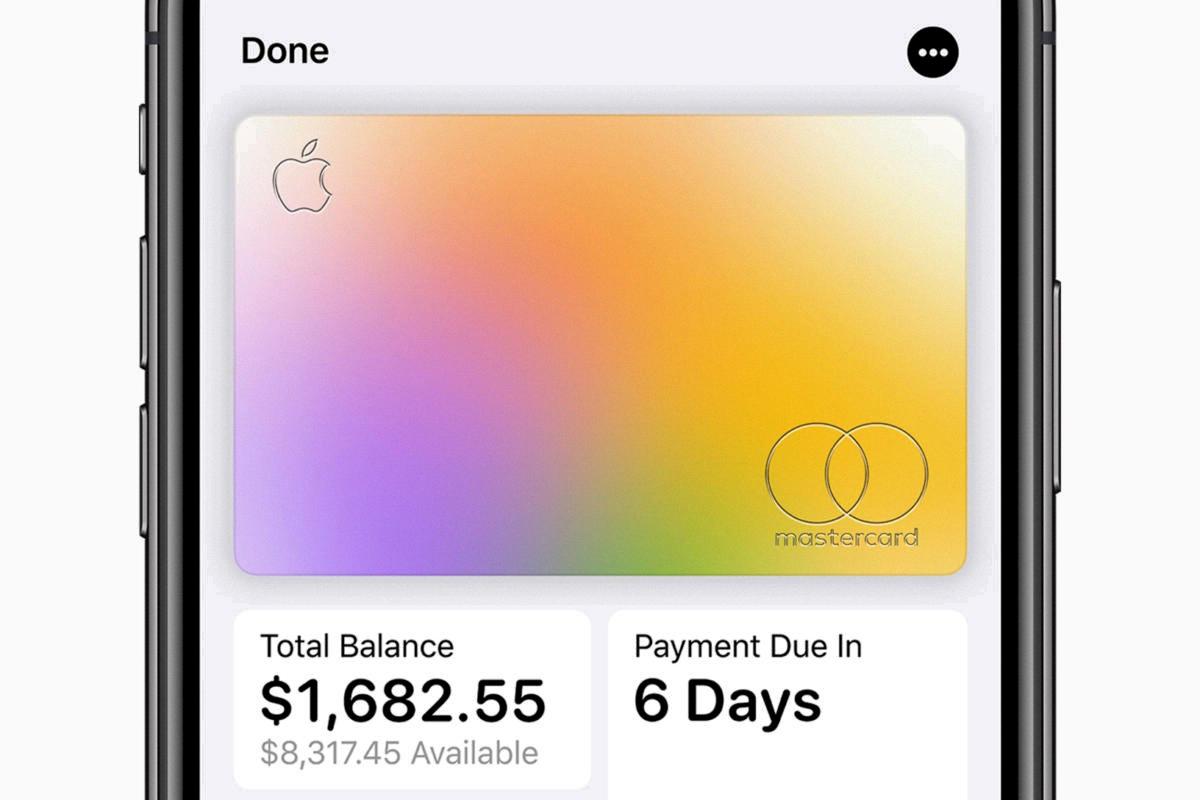

The Apple Card has gained popularity for its simplicity and ease of use, and one important aspect of managing your Apple Card is paying off your balance. In this article, we will explore various methods to pay your Apple Card balance and discuss the importance of paying it off in full.

To begin, you can access your Apple Card balance and payment options through the Wallet app on your iPhone. Simply open the app, tap on your Apple Card, and then tap on the More button. From there, select Monthly Installments to view the balance for all your monthly installments.

If you wish to pay off your balance early, you can do so by tapping on the Pay Early option. This will allow you to make a payment before the due date, helping you avoid any additional interest charges. It is important to note that paying your monthly balance in full every month on or before the due date is crucial to stop new interest charges from accruing.

By paying your balance in full and on time, you can avoid being charged interest on your outstanding balance. Failure to pay the monthly balance in full by the due date will result in interest charges being applied to your account. It is essential to be aware that while late fees are not charged for missed payment deadlines, you are still responsible for the interest applied to your balance on the payment due date, and you may accumulate additional interest.

Now let’s explore the different methods of making payments on your Apple Card. One option is to pay your balance online directly through the Wallet app. This allows for a quick and convenient payment process. Alternatively, you can make a payment over the phone by calling (877) 255-5923. If you prefer traditional methods, you can also make a payment by mail.

It is important to emphasize the significance of paying your Apple Card balance in full every month on or before the due date. This not only helps you avoid interest charges but also demonstrates responsible financial management. By staying on top of your payments, you can maintain a healthy credit score and financial standing.

Paying off your Apple Card balance should be a priority to ensure you are not accruing unnecessary interest charges. The Wallet app offers various options for making payments, including online, over the phone, or by mail. Remember to pay your balance in full every month on or before the due date to avoid interest charges and maintain a good credit score.

Can You Pay Off Apple Card Balance Early?

It is possible to pay off your Apple Card balance early. To do so, follow these steps:

1. Open the Wallet app on your iPhone.

2. Tap on the Apple Card option.

3. Tap the More button, which is represented by three dots.

4. From the options displayed, select Monthly Installments.

5. If you have multiple monthly installments, you will see the balance for all of them.

6. Tap on the Pay Early option.

7. A confirmation message will appear, informing you that paying early will reduce the total interest you owe.

8. Tap on Continue to proceed with the early payment.

By paying off your Apple Card balance early, you can reduce the amount of interest you owe and potentially save money in the long run.

Do You Have to Pay Your Entire Apple Card Balance?

It is essential to pay your entire Apple Card balance to avoid being charged interest. To clarify, when we mention paying your “entire balance,” we mean the total amount you owe on your Apple Card for that particular billing cycle. It includes any outstanding purchases, fees, or interest charges.

To ensure that you do not incur any interest charges, it is crucial to pay off your monthly balance in full every month. This means that you should pay the entire amount you owe on or before the due date mentioned on your statement. By doing so, you will prevent any interest from accruing on your account.

Paying your balance in full is a wise financial practice as it allows you to avoid unnecessary interest charges and maintain control over your credit card debt. Furthermore, it helps you establish a good credit history and improves your credit score.

To summarize, paying your monthly Apple Card balance in full and on time is the best way to avoid interest charges. Make sure to pay the total amount owed, including any outstanding purchases, fees, or interest charges, by the due date mentioned on your statement. By doing so, you will successfully stop new interest charges from accruing on your Apple Card account.

What Happens If You Don’t Pay Your Apple Card Balance?

If you do not pay your Apple Card balance by the due date, there are a few things that may happen:

1. Interest accrues: Even if there is no late fee, you will still be responsible for the interest that applies to your balance on the date the payment was due. This means that interest will continue to accumulate on the unpaid amount, increasing the overall amount you owe.

2. Additional interest may be applied: If you miss a payment deadline, you may accrue more interest on your outstanding balance. This can lead to a higher overall amount that you need to pay back.

3. Impact on credit score: Failing to make payments on time can have a negative impact on your credit score. Your credit history and payment behavior are factors that credit bureaus consider when calculating your credit score. Late or missed payments can lower your credit score, making it harder for you to obtain credit in the future.

4. Collection efforts: If you consistently fail to make payments, Apple Card may take collection actions to recover the outstanding balance. This can involve contacting you to arrange payment, reporting the debt to credit bureaus, or potentially pursuing legal action.

It is important to note that Apple Card, like any other credit card, requires responsible financial management. It is advisable to pay your balance on time to avoid accruing interest, maintain a good credit score, and prevent any potential collection efforts.

How Do You Pay Your Apple Card Balance By Phone?

To pay your Apple Card balance by phone, you can follow these steps:

1. Dial the phone number for Apple Card customer service, which is (877) 255-5923.

2. Once connected, listen to the automated menu options and select the appropriate option for making a payment.

3. Provide the necessary information as prompted, such as your Apple Card account number and any other authentication details required to verify your identity.

4. Follow the instructions to enter the payment amount you wish to make. It’s important to note that you can make either the minimum payment or pay off the full balance.

5. Confirm the payment details when prompted and ensure that all the information entered is accurate.

6. If required, provide the payment source information, such as your bank account details or credit card number, depending on the payment method you choose.

7. Review all the details provided before finalizing the payment to avoid any errors or discrepancies.

8. Once the payment is processed, you may receive a confirmation number or reference for your records. It’s recommended to note down this information for future reference.

Please keep in mind that while paying your Apple Card balance over the phone is convenient, you may also have other payment options available, such as making payments online or through the Wallet App. Consider exploring these alternatives as well to choose the method that suits you best.

Conclusion

It is important to pay your Apple Card balance on time and in full every month to avoid accruing interest charges. By paying your balance before the due date, you can stop new interest charges from being applied. It is recommended to pay your monthly balance in full to avoid being charged interest. While Apple Card does not charge late fees for missed payment deadlines, you are still responsible for the interest that applies to your balance on the date the payment was due. To make a payment, you can do so online or through the Wallet app. Additionally, payments can be made over the phone or through mail. Taking these steps will ensure that you maintain a healthy financial standing with your Apple Card and avoid unnecessary interest charges.