At Experian IdentityWorks, we’re all about providing our customers with the best identity protection and credit monitoring services available. Our goal is to help you safeguard your identity and protect your finances by keeping a close eye on your personal information and credit profile.

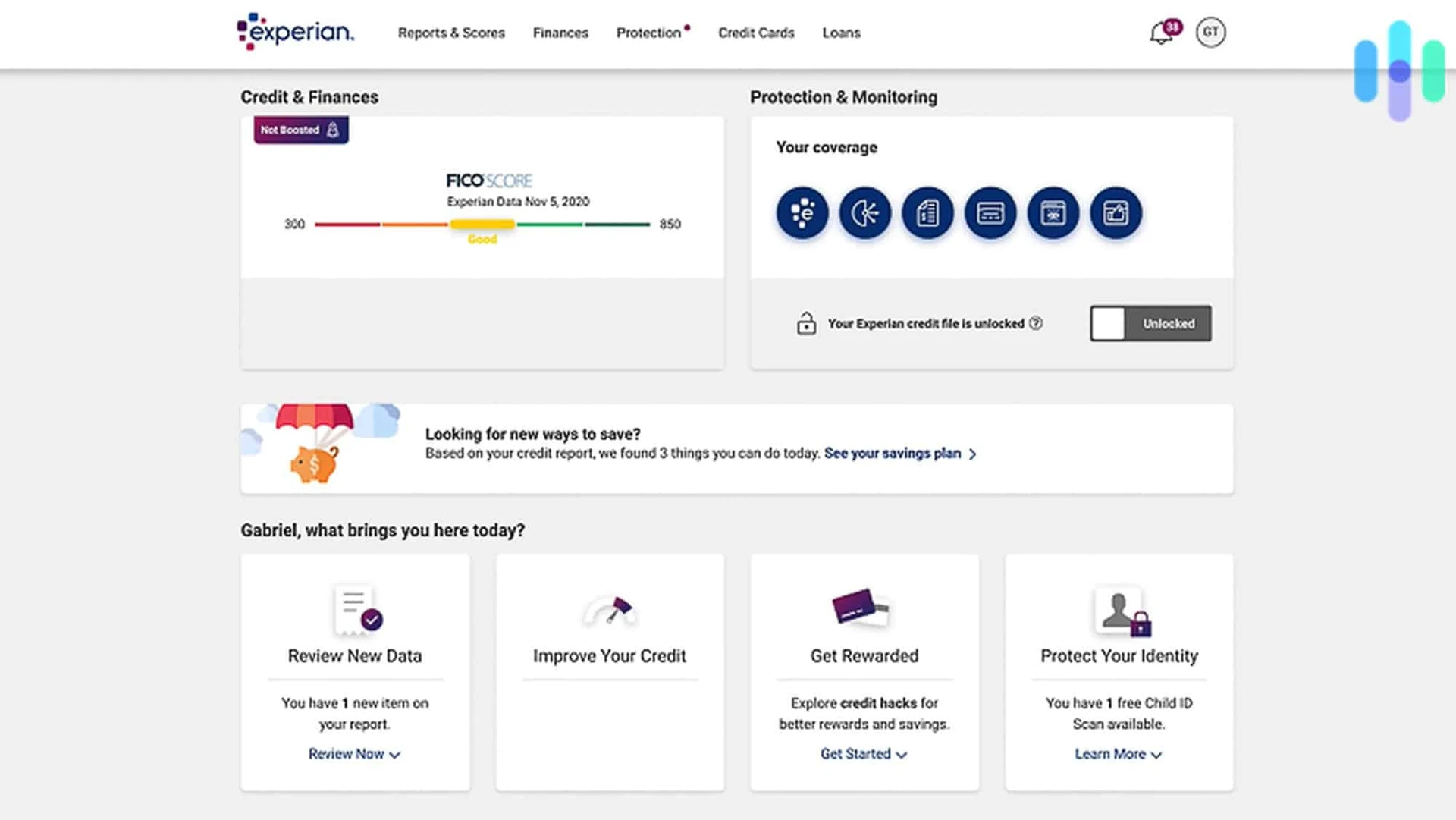

We believe that knowledge is power, which is why our service provides you with daily access to your FICO score as well as alerts for any credit inquiries or changes in large financial account balances. We also monitor the opening of new accounts, so you can rest assured that your information is safe and secure.

Our premium package offers comprehensive protection and allows you to stay on top of changes in all three credit bureaus – Experian, Equifax, and TransUnion – with a quarterly three-bureau credit report. That way, you can keep an eye out for any suspicious activity or discrepancies across all three bureaus.

But we don’t just stop there – our IdentityWorks Premium package also includes identity monitoring services to help protect against identity theft. We continually monitor millions of public records for use of your personal information, alerting you if something looks suspicious or out of the ordinary. Plus, in the event that something does happen, our experienced fraud resolution team is here to help with any necessary steps to restore your identity and protect against further damage.

At Experian IdentityWorks, we know how important it is to stay vigilant when it comes to protecting your personal information and financial security – that’s why we are committed to providing our customers with top-notch protection they can trust.

Is Experian IdentityWorks Legitimate?

Yes, Experian IdentityWorks is real. Experian IdentityWorks is a subscription service designed to help protect your identity and credit. With IdentityWorks, you can monitor your credit report and score from all three major credit bureaus, receive alerts for significant changes to your financial accounts, and get identity theft protection with up to $1 million in insurance coverage. With IdentityWorks, you can also access exclusive savings offers from the leading brands you know and trust. Plus, you’ll get around-the-clock help from experienced specialists who are dedicated to helping you recover if you experience any fraud or identity theft.

Are Experian and Experian IdentityWorks the Same?

No, Experian and Experian IdentityWorks are not the same. Experian is a consumer credit reporting agency that collects and reports consumer credit information to businesses. Experian IdentityWorks is an identity theft protection service offered by Experian that helps protect your personal information. This service provides comprehensive credit monitoring features to keep tabs on any changes or suspicious activity on your credit report. In addition, it also offers fraud resolution assistance should you become a victim of identity theft or fraud.

Differences Between Experian CreditWorks and IdentityWorks

Experian CreditWorks and IdentityWorks are both premium services from Experian that help you monitor and protect your credit. CreditWorks Premium offers daily Experian credit reports, as well as monthly three-bureau credit reports to monitor all three bureaus (Equifax, Experian, and TransUnion). IdentityWorks Premium also offers most of the same perks as Creditworks Premium, including credit reports monitored by all three bureaus, but with a quarterly three-bureau credit report instead of monthly.

In addition to credit monitoring, both services offer identity theft protection. This includes identity theft insurance, fraud resolution support, and dark web scanning. Both services also offer access to online education tools to help users better understand their finances and how to protect themselves from fraud or identity theft.

Is Experian Identity Service Secure?

Experian Identity Service is a reliable identity monitoring service that provides consumers with a detailed look at their credit scores and personal information. The service has not experienced any data breaches in recent memory, so customers can feel confident that their personal information is safe. Experian also offers 24/7 fraud resolution support and an online dashboard to help customers manage their finances. Furthermore, the company provides up-to-date alerts on changes to your credit report, so you can stay informed of any suspicious activity. All in all, Experian Identity Service is a secure and dependable way to protect your identity.

The Need for Social Security Numbers in Experian’s Processes

Experian needs your Social Security number to ensure the accuracy of your credit report. The Social Security number is a unique identifier that helps Experian verify your identity. This information helps Experian compile reports that contain only accurate and up-to-date information about you, so it’s important for you to provide accurate information when ordering your own credit report. Providing this information also helps Experian protect your personal identity from fraudsters and scammers. Your Social Security number will be used in a secure manner and kept confidential, so you can have peace of mind knowing that your personal information is safe with us.

Does Experian Share Personal Information?

No, Experian does not sell your personal information. We recognize the importance of protecting your privacy and we take steps to protect all the data that you entrust to us. We are committed to respecting and protecting your privacy in accordance with applicable laws, regulations, and industry standards. We do not sell or rent any personal information collected from our customers or other users of our websites to any tird parties. We also do not disclose your personal information to any third party without your permission, unless it is necessary for us to provide you with a service you have requested or as required by law or regulation.

Is Experian IdentityWorks Free?

No, Experian IdentityWorks is not free. However, you can start a 30-day trial membership for free with a credit card. During the trial period, you can use all the features and services of Experian IdentityWorks Plus or Experian IdentityWorks Premium without any charge. You may cancel your trial membership at any time within 30 days without being charged.

The Reasons Behind Experian’s Lack of Identity Verification

Experian does not verify identity in order to protect the security and accuracy of our customer’s data. In order to ensure that your personal information is secure, we use a number of methods to verify your identity, such as asking for specific pieces of personally identifiable information or requesting a photo ID. If we are unable to verify your identity through these methods, then this may be due to a discrepancy in the data that you have provided or the lack of sufficient verification documents.

Verifying Identity with Experian

Experian verifies identity by using a series of verification questions that are derived from information contained in your credit report. These questions may include asking for personal information such as your name, address, date of birth, and other details about your financial history. Experian also uses additional verification techniques to ensure the accuracy of the information provided and protect your identity from fraud. This can include verifying contact information with outside sources, analyzing account activity patterns, or using two-factor authentication methods.

Does Experian IdentityWorks Provide Credit Scores?

Yes, Experian IdentityWorks does show a credit score. Experian IdentityWorks provides consumers with access to their credit scores generated using the Experian Vantage 3.0 model. The Experian Vantage 3.0 model is a widely-used system that evaluates a consumer’s creditworthiness based on the data in their credit report. This score ranges from 300 to 850, with higher scores indicating more favorable creditworthiness and lower scores indicating less favorable creditworthiness. By subscribing to Experian IdentityWorks, consumers can keep an eye on their credit score and take proactive steps to improve it if necessary.

The Benefits of Using Experian for Businesses

Most companies use Experian because of its reliable and comprehensive set of data. Experian provides an array of information on accounts, such as the minimum payment due, payment amounts, and balances. The accuracy and detail of this data make it invaluable to companies that are looking to make informed decisions about creditworthiness. Additionally, with more companies using Experian for credit reporting than Equifax, debt is more likely to appear on Experian reports which is a great asset for businesses that need to assess risk when making lending decisions. Finally, Experian also offers a wide range of services and tools to help businesses better understand their customer’s financial health and manage risk more effectively. All these factors make Experian an attractive choice for many businesses when it comes down to choosing a credit reporting agency.

The Purpose of Experian’s Identity Alerts

Experian sends identity alerts to help protect you from potential identity theft. An identity alert is a notification that Experian has detected changes to your credit file that could indicate a risk of fraud or identity theft. By monitoring your Experian account, we can help you detect suspicious activity, such as unauthorized account openings or inquiries into your credit history, and take steps to help prevent any further harm.

Conclusion

In conclusion, Experian IdentityWorks is a great option if you’re looking for reliable credit monitoring and identity protection. It offers an impressive range of features, including daily Experian credit reports, credit utilization alerts, large financial account balance changes, and more. Plus, with quarterly three-bureau credit reports and fraud resolution assistance from the Experian credit bureau, you can trust that your personal information is safe. While it may not be the best identity monitoring service for privacy compared to other services on the market, Experian IdentityWorks does offer a secure way to keep track of your credit score and protect against identity theft. All in all, it’s an excellent choice for anyone looking for comprehensive identity protection.