When it comes to picking out the riht credit card, one of the most important factors to consider is the balance transfer rate. Most cards offer a balance transfer APR and/or fee, allowing you to move debt from one card to another in order to save money. But what if you’re looking at the Apple Card from Goldman Sachs? Unfortunately, if you’re hoping to transfer a balance from your Apple Card, you’ll be out of luck.

The Apple Card does not offer any kind of balance transfer option. According to the terms and conditions set by Goldman Sachs, Apple Cardholders can’t transfer any debts from their Apple Card onto any other credit card. This means that if you have debt on your Apple Card and want to move it over to another card in order to save money, you won’t be able to do so with this particular credit card.

Although not having a balance transfer option may be disappointing for some people, thre are still plenty of other benefits that come with having an Apple Card. For starters, there are no annual fees or foreign transaction fees associated with this card. It also has a relatively low APR for purchases and cash advances, as well as generous rewards such as 3% cash back on all purchases made with the Apple Pay app (2% cash back when you use your physical card).

It’s also important to note that while not bing able to transfer a balance may not impact your credit score directly, it could still have an effect on it indirectly. This is because transferring balances between cards can help build your credit history and improve your utilization ratio (the amount of available credit you use compared to how much total credit limit you have). By not having the option of transferring balances between cards, some people may find themselves struggling more with their overall debt management strategy than they would if they were able to move their debt around more freely.

Overall, while not being able to make balance transfers may be an inconvenience for some people who are interested in usig the Apple Card, there are still many benefits that come along with using this credit card—such as no foreign transaction fees and generous rewards—that make it a good choice for those who don’t frequently rely on transferring balances between accounts.

Does the Apple Card Allow Balance Transfers?

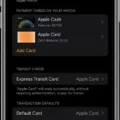

No, the Apple Card does not allow balance transfers. This is because the Apple Card’s terms and conditions from Goldman Sachs do not include a balance transfer APR or a balance transfer fee. Therefore, it is not posible to transfer balances from one card to the Apple Card. However, you can use your Apple Card to make purchases and payments with other cards if needed.

Source: card.apple.com

Transferring an Apple Card Balance to Another Credit Card

No, you cannot transfer your Apple Card balance to anoher credit card. This is in accordance with the rules set by Goldman Sachs, the bank behind the Apple Card. Unfortunately, cardholders are not allowed to transfer any debt from their Apple Card to any other card.

The Impact of Balance Transfers on Credit Scores

Balance transfers can have both positive and negative impacts on your credit score. On the plus side, transferring a balance to a card with a lower interest rate can save you money in the long run. It may also help you pay off your debt more quickly, which could help your credit score. However, if you open a new card to transfer the balance, it could case your credit utilization ratio to increase temporarily—which could hurt your score in the short term. Additionally, if you don’t use the transferred balance responsibly—like making late payments or going over your credit limit—this could also affect your score negatively. Ultimately, whether or not a balance transfer affects your credit depends on how you manage it and whether or not you open a new card for the transfer.

Conclusion

In conclusion, the Apple Card does not offer balance transfer APR or fees, and does not allow balance transfers from other cards. This is because of the rules set by Goldman Sachs, the bank behind the Apple Card. While this may be inconvenient for some cardholders, it ultimately serves to protect their credit scores since balance transfers can have an impact on one’s credit score depending on how they are handled. Ultimately, the Apple Card is designed to help cardholders stay within their budget and pay off their debts responsibly without havng to worry about debt transfers.