The Apple Card is a revolutionary new credit card designed to provide customers with a simplified and secure way to make their purchases. With the Apple Card, you can easily manage your spending, get access to exclusive benefits, and use the available credit after payment feature to help you pay off your balance faster.

The available credit after payment feature is one of the most unique features of the Apple Card. When you make a purchase with your Apple Card, the amount due will be deducted from your available credit on that day. That means that you can use up to 100% of your available credit after making a payment. This allows you to keep more money in your pocket and pay off your balance faster.

The Apple Card also offers rewards for every purchase you make with it. You’ll earn 3% cash back on all purchases made directly through Apple, 2% cash back on all purchases made through Apple Pay and 1% cash back on all other purchases. These rewards are added directly to your account each month and can be used towads future purchases or applied as a statement credit towards your balance.

Finally, the Apple Card also offers great security features such as fraud protection, secure transactions, and real-time notifications when suspicious activity is detected on your account. You can also freeze or unfreeze your card at any time in case it’s lost or stolen so that no one else can use it without permission.

Overall, the Apple Card provides customers with an easy to use way to manage their accounts while getting access to great benefits and rewards. With its unique aailable credit after payment feature and superior security measures, it’s easy to see why more people are choosing the Apple Card for their everyday purchases!

How Long Does it Take to Receive Available Credit After Payment?

It typically takes one to two (1-2) business days for funds to become available after you make a payment. This means that if you make a payment before the cutoff time on Thursday, the funds shold be available to use on Friday. Remember to take weekends and holidays into account when calculating how long it will take for funds to be available!

Source: card.apple.com

How Long Does It Take for Apple Card Credit to Refresh?

Hi, it typically takes 1-2 days for your Apple Card credit to update and be aailable for use. This is usually true when you make payments or receive additional credit from Apple Card. If you’ve recently made a payment or received additional credit from Apple Card, please allow up to 2 days for the new total to reflect in your available credit.

The Impact of Payments on Available Credit

Yes, available credit does go up after payment. When you make a payment on your credit card balance, the amount of available credit will increase util you make a new purchase. The amount of available credit is determined by subtracting your current balance from your total credit limit. So if your total credit limit is $500 and you have a current balance of $250, then you have an available credit of $250. After making a payment of $50, the available credit will increase to $300.

No Available Credit After Paying Off Credit Card

It is posible that the card issuer has put a hold on your account due to one or more of the following reasons: going over your credit limit, missing payments, or making a habit of either of these behaviors. If this is the case, it is likely that the card issuer wants to ensure that you have improved your financial management and can handle credit responsibly before they approve any new spending on the account. To get back into good standing with your card issuer, it is important to make all payments on time and avoid going over your credit limit. Once the card issuer sees that you are managing your finances responsibly, they may be willing to increase your available credit again.

Processing Time for Apple Card Payments

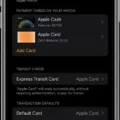

It generally takes 1-3 business days for payments to process with your Apple Card. If you use Apple Cash balance to make a payment, the credit is applied immediately and will show up on your card balance right away. You can also set up an automatic payment schedule so that your payments are made on time every month.

Source: forbes.com

Transitioning from Current Balance to Available Balance: How Long Does It Take?

The current balance of a bank account typically becomes available as an available balance within two to five business days. This is true for most banks, howver some banks may hold checks from accounts that are frequently overdrawn. In these cases, it may take longer than usual for an amount to become available, so it’s important to check with your bank if you’re unsure of their policy.

Does Making the Minimum Payment Reset a Credit Limit?

Yes, making a minimum payment will reset your credit limit. After you make the minimum payment, your available credit limit will be reset to the amount of your total credit limit minus the amount you spent duing the current billing cycle. For example, if your total credit limit is $1,000 and you spend $500 during the current billing cycle, then after making a minimum payment your available credit limit will be reset to $500. Making additional payments on top of the minimum payment can help increase your available credit even more.

Increasing Available Credit

To make your available credit go up, you’ll need to demonstrate responsible use of credit and increase your overall creditworthiness. This can be done by paying your bills on time, keeping your balances low, and avoiding taking on too much new debt. Additionally, you may want to take steps such as requesting a credit limit increase from lenders or opening a new line of credit. By taking these steps and managing your existing accounts responsibly, you can work towrds increasing your available credit.

Investigating the Lack of Available Credit

Your Available Credit may not be showing up for a few different reasons. First, it is possible that a payment or other Transaction has not yet been processed or posted to the Account. Additionally, some Merchants may pre-authorize the amount or estimated amount of a Purchase and this will reduce the Available Credit. Lastly, it could be that your credit card company has not yet reported the new infrmation to your account. If you believe there is an error in reporting, we recommend contacting your credit card company directly.

What Could Be the Reason for My Credit No Longer Showing Up?

If you haven’t used credit in over 10 years, it’s likely that your old accounts have been removed from your credit report by now. This means that there is no longer any information in your credit history to generate a score. Credit scores are based on the data found in your credit report, so if there is nothing in the report, there is nothing to be scored.

Conclusion

The Apple Card is a great choice for those looking for an easy and secure way to manage their finances. It offers a variety of benefits, such as no annual fees, low interest rates, cash back rewards, and no foreign transaction fees. Additionally, it integrates seamlessly with Apple Pay to provide an enhanced user experience. All of these features make the Apple Card a great option for individuals who are looking for a secure and convenient way to manage their finances.