When it comes to staying up-to-date with the latest technology, an iPhone is one of the most desirable items to own. But sometimes, affording the latest version can be difficult. That’s where iPhone Afterpay comes in.

iPhone Afterpay alows you to spread out your payments over four installments, with no interest or additional fees. For example, if you purchase a new iPhone for $1,000, instead of paying for it all upfront, you can make four payments of $250 each. You pay the first installment when you place your order and the rest of the payments will be deducted from your debit card automatically every two weeks.

Plus, iPhone Afterpay allows you to receive your device right away and start using it while making manageable payments. With this payment plan, thre are no financial surprises or hidden costs; what you see is what you get.

It’s important to note that iPhone Afterpay is not a credit card or loan product; rather it’s a simple and secure way to install your purchases without having to wait unil you have saved up enough money for the full price upfront. Additionally, iPhones purchased through Afterpay are sent out from Apple stores the same day as long as they are ordered before 3pm AEST on business days.

If you’re looking for a convenient and secure way to buy an iPhone witout having to pay for it all at once, then iPhone Afterpay may be just what you need!

Using Afterpay to Purchase an iPhone

Yes, you can use Afterpay for iPhone! You can use Afterpay to make purchases in-store or online with your Apple device. To make an in-store purchase, launch the Afterpay app and tap the ‘In-store’ tab to see the pre-approved amount you have available to spend. When you’re ready to check out, select ‘Use Apple Pay’ and confirm your payment with your fingerprint or Face ID. For online purchases, select ‘Apple Pay’ at checkout and follow the steps to confirm your payment. Please note that not all merchants accept both Afterpay and Apple Pay, so check before you shop!

Source: bloomberg.com

Can You Purchase Apple Products Using Afterpay?

Yes, you can get Apple products on Afterpay! With Afterpay, you can purchase the latest Apple products including iPhones, iPads, Macs, AirPods and more. All you need to do is select Afterpay as your payment method when checking out in the Apple App Store or at any physical retail store that supports Afterpay. Once your purchase is complete, you can pay for it in four easy fortnightly instalments – interest-free! Plus, if you pay on time each fortnight, you won’t pay any extra fees. So why wait? Get the latest Apple products today with Afterpay!

Purchasing an iPhone on a Monthly Payment Plan

Yes, you can purchase an iPhone with monthly payments. This is knon as the iPhone Payments option and is available to qualified customers. When you choose to pay with iPhone Payments, you purchase your iPhone through a monthly installment loan. Additionally, you must also activate the device with a qualifying wireless service plan provided by an eligible carrier. Once approved for financing, your monthly payment will be based on the total cost of the phone and any applicable taxes.

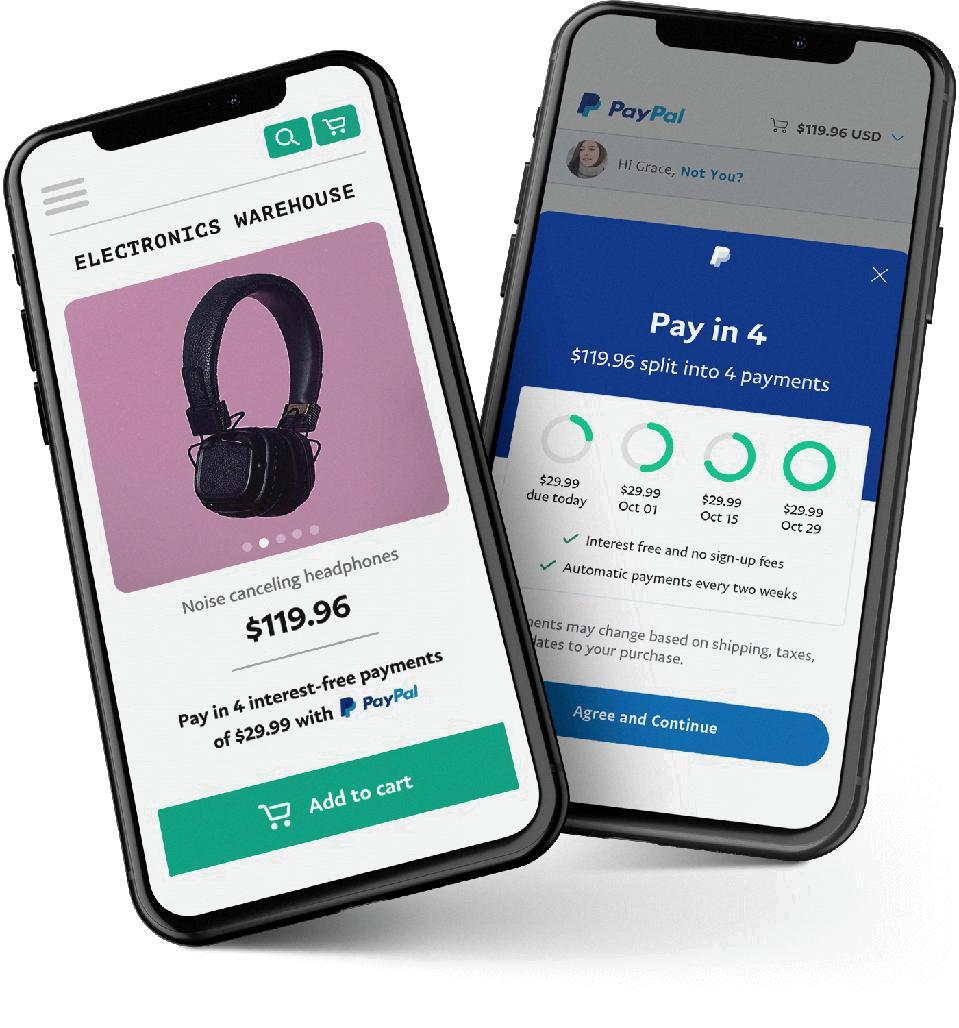

Does Apple Offer Buy Now, Pay Later?

Yes, Apple does offer Buy Now, Pay Later as part of its new operating system, iOS 16. Through Apple Pay Later, US customers will be able to purchase items and spread the cost into four payments over six weeks without paying interest or fees. This is a great way to manage your budget and make purchases without worrying abot high interest rates or hidden fees.

Can Afterpay Be Used at Best Buy?

No, you cannot use Afterpay at Best Buy. Best Buy does not currently accept payment through Afterpay. Instead, people can make payments for their shopping with Best Buy credit cards as well as lease to own options. Additionally, customers can use the My Best Buy Credit Card, which allows customers to pay over time and earn rewards points on every purchase made at Best Buy or at any other store that accepts the My Best Buy Credit Card. Customers can also make payments with a Best Buy Gift Card, MasterCard, Visa, American Express, Discover Card or Cash.

Does Amazon Accept Afterpay?

No, Amazon does not accept Afterpay as a payment option. Afterpay is an Australian-based company that allows customers to pay for goods and services in four instalments. Amazon currently offers several other payment options, including major credit cards, debit cards, gift cards, and Amazon Pay.

Paying for Apple Products on a Monthly Basis

Yes! You can pay for a new iPhone, iPad, Mac, or other eligible Apple product with Apple Card Monthly Installments. This is an easy payment option that allws you to enjoy interest-free, low monthly payments — instead of paying all at once. To use this option, simply select “Monthly Installments” when you check out with your Apple Card. You will then be able to review the details of your monthly payment plan before confirming your purchase.

The Benefits of Paying for an iPhone in Full or Monthly

It ultimately depends on your budget and what works best for you. Paying in full upfront will give you the most savings, as retailers may offer discounts or other incentives for buying the phone outright. However, if you don’t have the funds to pay in full, there are many options for financing an iPhone and paying for it over time in monthly installments. This way, you can spread out the cost of the phone and make smaller payments over a longer period of time. Just make sure to take into account any interest charges or other fees asociated with financing your purchase before deciding which option is best for you.

Banks Offering iPhones on Installment Plans

Bank Alfalah is offering iPhone 12 on easy installments starting from just Rs. 8,469 a month with its Credit Cards. You can enjoy the benefits of purchasing your dream iPhone 12 on installments and pay in flexible tenures ranging from 3 months to 36 months. All you need to do is select Bank Alfalah Credit Card as your payment option and get your desired iPhone 12 now!

Source: twitter.com

Does Afterpay Help Build Credit?

No, Afterpay does not build credit. Afterpay is a buy-now-pay-later service that allows customers to purchase items and pay for them in installments over time. It does not act as a lender, so it does not report your payments to the credit bureaus, which means it will not help you build or improve your credit score. However, if you are able to make all of your payments on time and in full, then Afterpay can help you avoid debt and maintain financial stability.

Can I Use Afterpay at Target?

Yes! You can use Afterpay at Target in the USA. All you need to do is select it as your payment method when shopping on Target.com or in the Target mobile app. Afterpay splits your purchase into 4 equal payments, due every two weeks without any interest or additional fees. Once you’ve made the first payment, you’ll receive your order within 24-48 hours. To use Afterpay at Target, all you need is a valid debit or credit card and a U.S. billing address and shipping address. It’s that simple! With Afterpay, shopping at Target has neer been easier or more affordable!

Does Walmart Offer Afterpay?

No, Walmart does not currently offer Afterpay as a payment method. However, there are other ‘Buy Now, Pay Later’ payment options available for those looking to purchase items from Walmart. These include Klarna and Sezzle. With Klarna, shoppers can choose to pay for their purchase in four equal installments over six weeks with no interest or fees. With Sezzle, shoppers can split their purchase into 4 payments over 6 weeks, also with no interest or fees. To use either of these payment methods at Walmart, simply select the option during checkout and complete the steps required to set up your account.

Can I Use Afterpay for Gas?

No, unfortunately you cannot use Afterpay for gas. Afterpay is a payment service that allows customers to pay for items in four installments over an eight-week period. This service is only availale for retail purchases, and is not accepted at gas stations. However, if you are looking to pay for gas with installments, there are other options available. Klarna recently partnered with Chevron and Texaco to offer installment payment options on fuel purchases.

Source: forbes.com

Can Afterpay Card Be Used Everywhere?

No, you cannot use Afterpay card anywhere. Afterpay is an online payment system that allows customers to pay for teir purchases in four equal installments over a period of 8 weeks. To use Afterpay, you must first create an account and link a valid credit or debit card to it. Currently, Afterpay can only be used with select retailers both online and in-store. To find out which retailers accept Afterpay, you can visit the Afterpay website or app and check the list of participating stores.

Does Footlocker Offer Afterpay?

Yes, Foot Locker now offers Afterpay as a payment option! Afterpay allows you to purchase your items now, receive them right away and make 4 interest-free payments over 8 weeks. It’s a great way to spread out the cost of your purchase without having to pay the full amount upfront. You can use Afterpay when shopping online or in select Foot Locker stores.

Conclusion

IPhone Afterpay is a convenient and secure way to purchase the latest iPhone models. With this service, customers can pay for teir device in four installments across two months, with no interest or fees charged. Customers also benefit from a 14-day money back guarantee if they are not completely satisfied with their purchase. Furthermore, customers can use their existing Apple ID to set up an Apple Pay account and speedily complete the payment process. In conclusion, iPhone Afterpay provides an easy and hassle-free way to purchase the latest iPhone models without having to worry about high upfront costs or hidden fees.